How to Calculate your Financial Break-even Point

Many business owners do not understand the importance of the break-even point and how it can be calculated.

The break-even point is the point at which the business covers its costs and thus breaks even. This allows you to discover exactly how much you must sell at the present level of costs to avoid making a loss. You can regularly check the progress of your business by comparing sales achieved with the break-even point. To accurately calculate your break-even point, the fixed and variable costs on which you base the calculation must be correct.

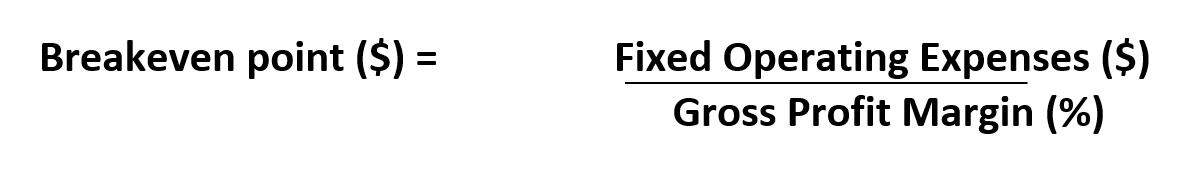

The break-even formula is fixed costs divided by gross profit margin, expressed as a percentage.

1) Calculate the total of your operating expenses (overheads) for the month and put this at the top of your equation.

2) Calculate your gross profit margin and put this at the bottom of your equation.

– Gross profit margin = gross profit for the month (income less cost of goods sold) divided by total income for the month.

3) Divide fixed operating expenses by gross profit margin to calculate your break-even point in dollars ($).

This same principle can be used to evaluate the effectiveness of your advertising. For more information on break-even point, contact the team at PROTRADE United